Introduction

Paystation APIs

There are a variety of ways to interact with Paystation using an API call. Below you’ll find information on all of our accepted API calls and transaction types.

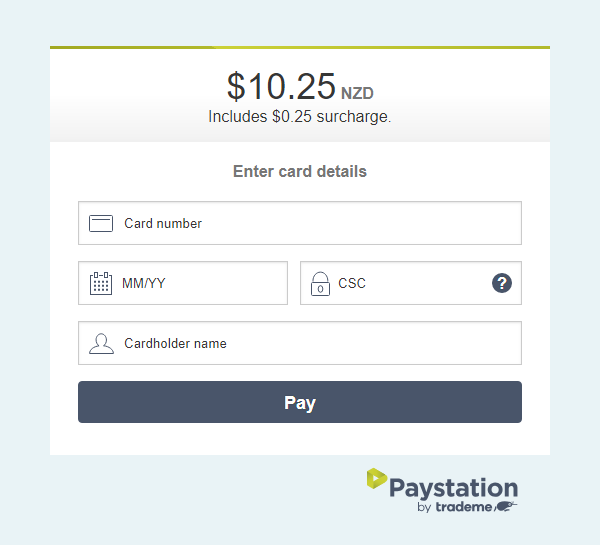

Fully hosted (3 party)

Fully hosted, referred to in our API documentation as a 3 Party integration, is when the payment form is hosted on our servers. This is the most common integration type, and most likely to gain bank approval in New Zealand. Use our 3 party APIs to complete most integration types.

There are two ways to reach our payment page in a 3 party integration. You can use a redirect, or an iframe. Our sample code gives options for a redirect or iframe and can be found here.

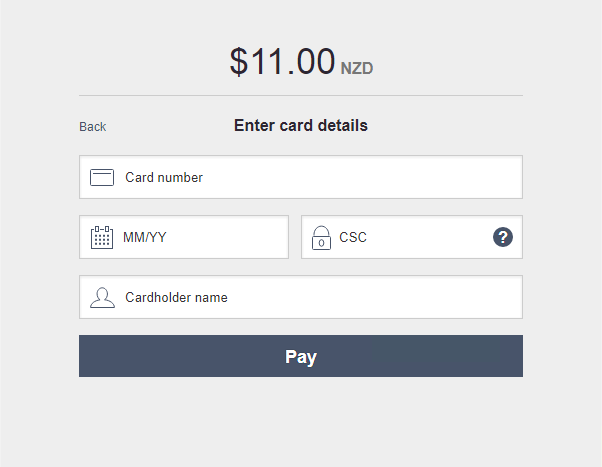

Merchant hosted (2 party)

Merchant hosted, referred to in our API documentation as a 2 Party integration, is when the payment page is hosted on the merchant’s website.

A merchant hosted (2 party) integration will require bank approval. PCI DSS compliance regulations will need to be met before an integration can go live also. While Paystation are more than happy to assist with a 2 party integration type, it pays to ensure that the merchant has approval for this before undertaking any significant development.

2 party

This secure interface allows you to complete a direct integration between Paystation and a website, platform, or application.

3 party

This HTTP interface allows the customer facing payment page to be hosted on Paystation’s servers. Whilst protecting your customer’s private details it also allows you to participate in the Verified by Visa and MasterCard Securecode fraud reduction schemes, reducing some of the risks of chargebacks. This type of processing is most likely to receive bank approval.

PayMe

PayMe allows for the creation of a payment URL, that includes a form. Once the form is completed and submitted the cardholder is sent through to our hosted payment page. A PayMe link can be either single or multiple use, and supports tokenisation.

Sample code

Paystation sample code is available for 2 party and 3 party integrations and can be found here

Currently we offer sample code for the below languages.

- PHP

- C#

- Java

- NodeJS

- ASP

If you believe you could help us extend our sample code base please contact us here

Errors

Transaction error code set

The Paystation API uses the following error codes:

Codes 0-9 relate to the response code from the ETSL, bank and pago payment systems. Codes 10-26 and 101, 102

and 104 would be identified during data validation, and are Paystation errors.

| Error Code | Error Message |

|---|---|

| -1 | Transaction could not be processed |

| 0 | Transaction successful |

| 1 | Transaction Declined - Bank Error |

| 2 | Bank declined transaction |

| 3 | Transaction Declined - No Reply from Bank |

| 4 | Transaction Declined - Expired Card |

| 5 | Transaction Declined - Insufficient funds |

| 6 | Transaction Declined - Error Communicating with Bank |

| 7 | Payment Server Processing Error - Typically caused by invalid input data such as an invalid credit card number. Processing errors can also occur |

| 8 | Transaction Declined / Transaction Type Not Supported - Transaction Type Not Supported |

| 9 | Bank Declined Transaction (Do not contact Bank) |

| 10 | Purchase amount less or greater than merchant values |

| 11 | Paystation couldn’t create order based on inputs |

| 12 | Paystation couldn’t find merchant based on merchant ID |

| 13 | Transaction already in progress |

| 14 | Transaction could not be found |

| 18 | Transaction type (TT) not specified |

| 19 | VPC returned data that is not valid - could have been tampered with! |

| 20 | POST Response URL does not seem to exist |

| 22 | Merchant_Ref contains invalid characters |

| 23 | Merchant Session (ms) contains invalid characters |

| 24 | 2 Party Transactions are not allowed by this merchant |

| 25 | URL encoding error |

| 26 | Invalid Amount |

| 32 | IP is not allowed |

| 40 | The type of transaction must have the No Redirect flag set to True |

| 41 | Card number has failed Luhn check |

| 101 | Merchant has been disabled |

| 102 | Browser type not supported |

| 104 | No return URL for merchant |

| 108 | Gateway Exception |

| 110 | Must use POST |

| 145 | To use Dynamic Return URLs, valid HMAC authentication must also be used. |

Token payments error code set

Future payment transaction errors are a subset of the transaction error code set

Codes 0-9 relate to the response code from the ETSL, bank and pago payment systems. Codes 10-26 and 101, 102

and 104 would be identified during data validation, and are Paystation errors

| Error Code | Error Message |

|---|---|

| 27 | Billing token already in use |

| 30 | Future Payment Token or Card Number is required |

| 31 | Future Payment Token not loaded |

| 34 | Future Payment Saved OK |

Refund error code set

Refund transaction errors are a subset of the transaction error code set

Codes 11-18, 33 and 101 would be identified during data validation, and are Paystation generated

errors

| Error Code | Error Message |

|---|---|

| 14 | Transaction could not be found |

| 16 | User not allowed to perform refunds |

| 17 | Merchant is not allowed to perform refunds |

| 18 | Transaction type not specified |

| 33 | Refund Token contains invalid characters |

| 42 | Refund amount too large |

Auth & capture error code set

Authorisation and capture transaction errors are a subset of the transaction error code set

| Error Code | Error Message |

|---|---|

| 35 | Merchant in purchase mode. You must not use auth or capture flags |

| 36 | Merchant in pre-auth mode. You must specify if the transaction is an authoristation or capture |

Lookup error code set

| Lookup Code | Lookup Message | Description |

|---|---|---|

| 00 | Successful | No error – look-up successful |

| 02 | HMAC Validation failed for account [PAYSTATION_ID] | ... |

| 01 | Matching transaction not found | The transaction was not found. If you are certain that the transaction exists, it could be the transaction is a result of a ‘found’ transaction, which is not currently searched on quick look-ups. This error also occurs when the pi value is incorrect or the merchants Paystation account has been disabled |

| 03 | Access denied for user [PAYSTATION_ID] | The IP address for the server or computer making the request is not set up in the Paystation system. Contact the Paystation team requesting your IP to be added to the list of allowed hosts for your Paystation ID |

| 04 | Internal lookup error | .... |

Extended error code set

If the merchant account is set-up to accept Verify by Visa and SecureCode authenticated transactions, you can ask Paystation to have the extended error codes enabled for your account. These codes are in addition to the error result codes above and give information about specifically authentication errors.

| Error Code | Error Message |

|---|---|

| A | Transaction Aborted |

| C | Transaction Cancelled |

| D | Deferred Transaction |

| E | Card Issuer Institution Returned a Referral Response - e.g. Contact details to call bank |

| F | 3D Secure Authentication Failed |

| I | Card Security Code Failed |

| L | Shopping Transaction Locked (This indicates that there is another transaction taking place using the same shopping transaction number) |

| N | Cardholder is not enrolled in 3D Secure (Authentication Only) |

| P | Transaction is Pending |

| R | Retry Limits Exceeded, Transaction Not Processed |

| S | Duplicate OrderInfo used. (This is only relevant for Payment Servers that enforce the uniqueness of this field) |

| T | Address Verification Failed |

| U | Card Security Code Failed |

| V | Address Verification and Card Security Code Failed |

| Y | Cardholder is not enrolled in 3D Secure |

| ? | Response Unknown |

HMAC error code set

In addition to all standard error messages, when using HMAC authentication you can now receive an error code of 160 (HMAC validation failed).

| Error Code | Error Message |

|---|---|

| 28 | Secret Word submitted incorrectly. Please submit using POST. |

| 29 | Secret is incorrect |

| 160 | HMAC validation failed |

Transaction

The Transaction Flow

3-Party

The steps to perform when making a payment using the 3 party payment method are:

- Initiate the payment

POST /direct/paystation.dll - Store everything locally

- Redirect the card holder’s browser to the payment page.

- Card holder will fill in payment details

- Receive a POST response from Paystation containing the completion status of the transaction, you will store the results locally.

- When the card holder’s browser returns to your site interpret the result of transaction and action according to your business rules (issue receipt, send emails, etc).

2-Party

The steps to perform when making a payment using the 2 party payment method are:

- Send the card details and amount through

POST /direct/paysation.dll - Receive the response containing the status of the completed transaction

Purchase

A purchase is when card details are sent through to Paystation with a payment amount in a transaction request. Paystation will respond with an error code that reflects either a successful, or an unsuccessful transaction. Our API offers 3 different methods of completing a standard purchase against a credit card.

2 party

Example request

POST https://www.paystation.co.nz/direct/paystation.dll

POST body parameters

paystation=_empty

&pstn_nr=t

&pstn_pi=123456

&pstn_gi=PAYSTATION

&pstn_ms=abcd-defg-hijk

&pstn_am=5000

&pstn_2p=t

&pstn_cn=5555555555554444

&pstn_ex=1705

This endpoint is used to initiate a 2 party transaction

HTTP request

POST https://www.paystation.co.nz/direct/paystation.dll

Required POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| paystation | Transaction initiator flag | Required for payment engine | String value | _empty |

| pstn_nr | No Redirect flag | Required for payment engine | Single character "t" or "T" | T |

| pstn_pi | Paystation ID | The Paystation ID | String value | 612345 |

| pstn_gi | Gateway ID | The Gateway ID | String value | PAYSTATION |

| pstn_ms | Merchant Session ID | A unique identifier for every transaction attempt | String value (max 64 chars) | qwertyuiop1234567890 |

| pstn_am | Amount | Transaction amount | Integer only, default format is cents | 4200 |

| pstn_2p | Two party flag | Required for 2-party transactions | Single character "t" or "T" | T |

| pstn_cn | Card number | Credit/debit card number (13 - 19 characters) | Integer, no spaces in between card numbers | 5555555555554444 |

| pstn_ex | Card expiry date | Four character expiry date | Integer, no spaces in between year and month (default is yymm format) | 1705 |

Optional POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_cu | Currency | Currency the transaction will be created in | String value | USD |

| pstn_tm | Test mode | Used to create a transaction in test mode | Single character "t" or "T" | T |

| pstn_mr | Merchant reference | A non-unique identifier that can be assigned to a transaction | String value (max 64 chars) | abc123 |

| pstn_ct | Card type | Stating the card type can bypass the card selection screen of a 3-party transaction | String value (max 64 chars) | visa |

| pstn_df | Card expiry date format | Defines the format of the expiry date | "mmyy" or "yymm" | mmyy |

| pstn_af | Amount format | Defines the format of the amount | String value "dollars.cents" or "cents" | dollars.cents |

| pstn_mc | Customer details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_mo | Order details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_cc | Card security code | Three/Four digit code found on back of credit/debit card | String value | 100 |

| pstn_rf | Return format | Defines the response format from Paystation (default is XML) | String value | JSON |

| pstn_rl | Retailer location | Location of the retailer for the goods or services (Case sensitive) | String value "DOMESTIC_ONLY", "FOREIGN_ONLY" or "FOREIGN_AND_DOMESTIC" | DOMESTIC_ONLY |

Optional query string parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_HMACTimestamp | HMAC Timestamp | The timestamp generated immediately before the request is generated | integer | 1481496738 |

| pstn_HMAC | HMAC Hash | A hash of the request, the HMAC timestamp and the HMAC key | string | abc12345 |

HTTP response

The above command returns on SUCCESS an XML response structured like this:

<?xml version="1.0" standalone="yes"?>

<response>

<ec>0</ec>

<em>Transaction successful</em>

<ti>0085789579-01</ti>

<ct>mastercard</ct>

<merchant_ref/>

<tm>T</tm>

<MerchantSession>abcd-defg-hijk</MerchantSession>

<UsedAcquirerMerchantID/>

<TransactionID>0085789579-01</TransactionID>

<PurchaseAmount>5000</PurchaseAmount>

<SurchargeAmount/>

<Locale/>

<ReturnReceiptNumber>85789579</ReturnReceiptNumber>

<ShoppingTransactionNumber/>

<AcqResponseCode>00</AcqResponseCode>

<QSIResponseCode>0</QSIResponseCode>

<CSCResultCode/>

<AVSResultCode/>

<TransactionTime>2017-01-13 09:38:26</TransactionTime>

<PaystationErrorCode>0</PaystationErrorCode>

<PaystationErrorMessage>Transaction successful</PaystationErrorMessage>

<PaystationExtendedErrorMessage/>

<MerchantReference/>

<RetailerLocation>DOMESTIC_ONLY</RetailerLocation>

<CardNo>555555XXXXXXX444</CardNo>

<CardExpiry>1705</CardExpiry>

<TransactionProcess>purchase</TransactionProcess>

<TransactionMode>T</TransactionMode>

<BatchNumber>0113</BatchNumber>

<AuthorizeID/>

<Cardtype>MC</Cardtype>

<Username>123456</Username>

<RequestIP>192.168.1.1</RequestIP>

<RequestUserAgent>Mozilla/5.0 (Windows NT 10.0; WOW64)</RequestUserAgent>

<RequestHttpReferrer/>

<PaymentRequestTime>2017-01-13 09:38:26</PaymentRequestTime>

<DigitalOrderTime/>

<DigitalReceiptTime>2017-01-13 09:38:26</DigitalReceiptTime>

<PaystationTransactionID>0085789579-01</PaystationTransactionID>

<IssuerName>unknown</IssuerName>

<IssuerCountry>unknown</IssuerCountry>

</response>

The above command returns on FAILURE an XML response structured like this (The error code/message will vary depending on the resulting failure):

The error message and code will vary depending on the error

<?xml version="1.0" standalone="yes"?>

<response>

<ec>8</ec>

<em>Transaction type not supported</em>

</response>

| Attribute | Name | Description | Type | Example |

|---|---|---|---|---|

| ec | Error code | The error code status of the transaction | integer | 1 |

| em | Error message | The error message status of the transaction | string | Transaction successful |

| ti | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| ct | Card type | The card issuer | string | mastercard |

| merchant_ref | A non-unique identifier that can be assigned to a transaction | string | abc123 | |

| tm | Test mode | Denotes if the transaction was completed in test mode or not | string | t |

| MerchantSession | Merchant Session ID | A unique value to identify a transaction by | string | abcd-defg-hijk |

| UsedAcquirerMerchantID | ||||

| TransactionID | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| PurchaseAmount | Purchase amount | A positive integer in cent value or alternatively the option specified in the transaction representing the charged amount | positive integer or zero | 5000 |

| SurchargeAmount | Surcharge amount added to transaction amount | Integer only | default format is cents | 4200 |

| Locale | Locale | The language tag represents the language the response text is provided in | ||

| ReturnReceiptNumber | Return receipt number | The RRN number is a virtual terminal counter for the transaction and is not unique | positive 8 digit number | 85789579 |

| ShoppingTransactionNumber | Shopping transaction number | Is a unique number relating to the Transaction ID (eGate integration's only) | Integer | 85793423 |

| AcqResponseCode | Acq response code | Transaction response code from the acquiring bank | Integer | 00 |

| QSIResponseCode | QSI response code | Issuing bank response code – the actual raw result from the payment server. Please process transaction result from the PaystationErrorCode | Integer | 0 |

| CSCResultCode | CSC result code | The response code in response to verifying the card security code if applicable to transaction | Single character | "M" |

| AVSResultCode | AVS result code | Result of any AVS validation. Not supported in New Zealand | Empty | |

| TransactionTime | Transaction time | The time the transaction was completed | datetime | 2017-01-13 09:38:26 |

| PaystationErrorCode | Error code | The error code status of the transaction | integer | 1 |

| PaystationErrorMessage | Error message | The error message status of the transaction | string | Transaction successful |

| PaystationExtendedErrorMessage | Extended error message | Extra information regarding the error code if applicable | string value | Refer to card issuer |

| MerchantReference | Merchant reference | A non-unique identifier that can be assigned to a transaction | string | abc123 |

| RetailerLocation | Retailer location | Location of the retailer for the goods or services | string | DOMESTIC_ONLY |

| CardNo | Card number | A masked card number of the card that completed the transaction | string | 555555XXXXXXX444 |

| CardExpiry | Card expiry date | The expiry of the card that completed the transaction | date YYMM | 1705 |

| TransactionProcess | Transaction process | The transaction method identification | string | purchase |

| TransactionMode | Transaction mode | T or P represents the transaction is a test (T) or production (P) transaction | string value | T |

| BatchNumber | Batch number | A four digit number representing the expected settlement date of the transaction in the format MMDD | date MMDD | 0518 |

| AuthorizeID | Authorize ID | A unique reference provided by the bank to trace the transaction | string value | R91194 |

| Cardtype | Card type | The card issuer | string | MC |

| Username | Paystation account ID | The Paystation account ID that initiated the transaction | integer | 123456 |

| RequestIP | Request ip | The ip used in the initiation of the request | string | 192.168.1.1 |

| RequestUserAgent | Request user agent | String that identifies the application client that initiated the transaction request | string | Mozilla/5.0 |

| RequestHttpReferrer | Request http referrer | HTTP referrer header if applicable to original transaction request | string value | https://www.example.com |

| PaymentRequestTime | Payment request time | The time the transaction was initiated at | datetime | 2017-01-13 09:38:26 |

| DigitalOrderTime | Digital order time | The hosted payment page URL link for the transaction | datetime | 2018-03-11 02:40:16 |

| DigitalReceiptTime | Digital receipt time | Timestamp the transaction URL was created (does not apply to 2-party transactions) | datetime | 2018-03-11 02:40:16 |

| PaystationTransactionID | Paystation transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| IssuerName | Issuer name | The card issuing institution if known | string | KIWIBANK LIMITED |

| IssuerCountry | Issuer country | The country the card was issued if known | string | NEW ZEALAND |

2.5 party

Example request

POST https://www.paystation.co.nz/direct/paystation.dll

POST body parameters

paystation=_empty

&pstn_nr=t

&pstn_pi=123456

&pstn_gi=PAYSTATION

&pstn_ms=abcd-defg-hijk

&pstn_am=5000

&pstn_2p=t

&pstn_VisaCheckoutCallId=12498125876125817625

This endpoint is used to initiate a 2.5 party transaction after the user has selected a card stores with Visa Checkout.

HTTP request

POST https://www.paystation.co.nz/direct/paystation.dll

Required POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| paystation | Transaction initiator flag | Required for payment engine | String value | _empty |

| pstn_nr | No Redirect flag | Required for payment engine | Single character "t" or "T" | T |

| pstn_pi | Paystation ID | The Paystation ID | String value | 612345 |

| pstn_gi | Gateway ID | The Gateway ID | String value | PAYSTATION |

| pstn_ms | Merchant Session ID | A unique identifier for every transaction attempt | String value (max 64 chars) | qwertyuiop1234567890 |

| pstn_am | Amount | Transaction amount | Integer only, default format is cents | 4200 |

| pstn_2p | Two party flag | Required for 2-party transactions | Single character "t" or "T" | T |

| pstn_VisaCheckoutCallId | Visa Checkout Call ID | Call ID returned from a successful visa checkout initiation. | Numeric | 12498125876125817625 |

Optional POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_cu | Currency | Currency the transaction will be created in | String value | USD |

| pstn_tm | Test mode | Used to create a transaction in test mode | Single character "t" or "T" | T |

| pstn_mr | Merchant reference | A non-unique identifier that can be assigned to a transaction | String value (max 64 chars) | abc123 |

| pstn_ct | Card type | Stating the card type can bypass the card selection screen of a 3-party transaction | String value (max 64 chars) | visa |

| pstn_af | Amount format | Defines the format of the amount | String value "dollars.cents" or "cents" | dollars.cents |

| pstn_mc | Customer details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_mo | Order details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_cc | Card security code | Three/Four digit code found on back of credit/debit card | String value | 100 |

| pstn_rf | Return format | Defines the response format from Paystation (default is XML) | String value | JSON |

| pstn_rl | Retailer location | Location of the retailer for the goods or services (Case sensitive) | String value "DOMESTIC_ONLY", "FOREIGN_ONLY" or "FOREIGN_AND_DOMESTIC" | DOMESTIC_ONLY |

HTTP response

The above command returns on SUCCESS an XML response structured like this:

<?xml version="1.0" standalone="yes"?>

<response>

<ec>0</ec>

<em>Transaction successful</em>

<ti>0085789579-01</ti>

<ct>mastercard</ct>

<merchant_ref/>

<tm>T</tm>

<MerchantSession>abcd-defg-hijk</MerchantSession>

<UsedAcquirerMerchantID/>

<TransactionID>0085789579-01</TransactionID>

<PurchaseAmount>5000</PurchaseAmount>

<SurchargeAmount/>

<Locale/>

<ReturnReceiptNumber>85789579</ReturnReceiptNumber>

<ShoppingTransactionNumber/>

<AcqResponseCode>00</AcqResponseCode>

<QSIResponseCode>0</QSIResponseCode>

<CSCResultCode/>

<AVSResultCode/>

<TransactionTime>2017-01-13 09:38:26</TransactionTime>

<PaystationErrorCode>0</PaystationErrorCode>

<PaystationErrorMessage>Transaction successful</PaystationErrorMessage>

<PaystationExtendedErrorMessage/>

<MerchantReference/>

<RetailerLocation>DOMESTIC_ONLY</RetailerLocation>

<TransactionProcess>purchase</TransactionProcess>

<TransactionMode>T</TransactionMode>

<BatchNumber>0113</BatchNumber>

<AuthorizeID/>

<Cardtype>MC</Cardtype>

<Username>123456</Username>

<RequestIP>192.168.1.1</RequestIP>

<RequestUserAgent>Mozilla/5.0 (Windows NT 10.0; WOW64)</RequestUserAgent>

<RequestHttpReferrer/>

<PaymentRequestTime>2017-01-13 09:38:26</PaymentRequestTime>

<DigitalOrderTime/>

<DigitalReceiptTime>2017-01-13 09:38:26</DigitalReceiptTime>

<PaystationTransactionID>0085789579-01</PaystationTransactionID>

<IssuerName>unknown</IssuerName>

<IssuerCountry>unknown</IssuerCountry>

</response>

The above command returns on FAILURE an XML response structured like this (The error code/message will vary depending on the resulting failure):

The error message and code will vary depending on the error

<?xml version="1.0" standalone="yes"?>

<response>

<ec>8</ec>

<em>Transaction type not supported</em>

</response>

| Attribute | Name | Description | Type | Example |

|---|---|---|---|---|

| ec | Error code | The error code status of the transaction | integer | 1 |

| em | Error message | The error message status of the transaction | string | Transaction successful |

| ti | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| ct | Card type | The card issuer | string | mastercard |

| merchant_ref | A non-unique identifier that can be assigned to a transaction | string | abc123 | |

| tm | Test mode | Denotes if the transaction was completed in test mode or not | string | t |

| MerchantSession | Merchant Session ID | A unique value to identify a transaction by | string | abcd-defg-hijk |

| UsedAcquirerMerchantID | ||||

| TransactionID | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| PurchaseAmount | Purchase amount | A positive integer in cent value or alternatively the option specified in the transaction representing the charged amount | positive integer or zero | 5000 |

| SurchargeAmount | Surcharge amount added to transaction amount | Integer only | default format is cents | 4200 |

| Locale | Locale | The language tag represents the language the response text is provided in | ||

| ReturnReceiptNumber | Return receipt number | The RRN number is a virtual terminal counter for the transaction and is not unique | positive 8 digit number | 85789579 |

| ShoppingTransactionNumber | Shopping transaction number | Is a unique number relating to the Transaction ID (eGate integration's only) | Integer | 85793423 |

| AcqResponseCode | Acq response code | Transaction response code from the acquiring bank | Integer | 00 |

| QSIResponseCode | QSI response code | Issuing bank response code – the actual raw result from the payment server. Please process transaction result from the PaystationErrorCode | Integer | 0 |

| CSCResultCode | CSC result code | The response code in response to verifying the card security code if applicable to transaction | Single character | "M" |

| AVSResultCode | AVS result code | Result of any AVS validation. Not supported in New Zealand | Empty | |

| TransactionTime | Transaction time | The time the transaction was completed | datetime | 2017-01-13 09:38:26 |

| PaystationErrorCode | Error code | The error code status of the transaction | integer | 1 |

| PaystationErrorMessage | Error message | The error message status of the transaction | string | Transaction successful |

| PaystationExtendedErrorMessage | Extended error message | Extra information regarding the error code if applicable | string value | Refer to card issuer |

| MerchantReference | Merchant reference | A non-unique identifier that can be assigned to a transaction | string | abc123 |

| RetailerLocation | Retailer location | Location of the retailer for the goods or services | string | DOMESTIC_ONLY |

| CardNo | Card number | A masked card number of the card that completed the transaction | string | 555555XXXXXXX444 |

| CardExpiry | Card expiry date | The expiry of the card that completed the transaction | date YYMM | 1705 |

| TransactionProcess | Transaction process | The transaction method identification | string | purchase |

| TransactionMode | Transaction mode | T or P represents the transaction is a test (T) or production (P) transaction | string value | T |

| BatchNumber | Batch number | A four digit number representing the expected settlement date of the transaction in the format MMDD | date MMDD | 0518 |

| AuthorizeID | Authorize ID | A unique reference provided by the bank to trace the transaction | string value | R91194 |

| Cardtype | Card type | The card issuer | string | MC |

| Username | Paystation account ID | The Paystation account ID that initiated the transaction | integer | 123456 |

| RequestIP | Request ip | The ip used in the initiation of the request | string | 192.168.1.1 |

| RequestUserAgent | Request user agent | String that identifies the application client that initiated the transaction request | string | Mozilla/5.0 |

| RequestHttpReferrer | Request http referrer | HTTP referrer header if applicable to original transaction request | string value | https://www.example.com |

| PaymentRequestTime | Payment request time | The time the transaction was initiated at | datetime | 2017-01-13 09:38:26 |

| DigitalOrderTime | Digital order time | The hosted payment page URL link for the transaction | datetime | 2018-03-11 02:40:16 |

| DigitalReceiptTime | Digital receipt time | Timestamp the transaction URL was created (does not apply to 2-party transactions) | datetime | 2018-03-11 02:40:16 |

| PaystationTransactionID | Paystation transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| IssuerName | Issuer name | The card issuing institution if known | string | KIWIBANK LIMITED |

| IssuerCountry | Issuer country | The country the card was issued if known | string | NEW ZEALAND |

3 party

Example request

POST https://www.paystation.co.nz/direct/paystation.dll

POST body parameters

paystation=_empty

&pstn_nr=t

&pstn_pi=123456

&pstn_gi=PAYSTATION

&pstn_ms=abcd-defg-hijk

&pstn_am=5000

This endpoint is used to initiate a 3 party transaction this will return a response that will include a URL for completing a transaction

HTTP request

POST https://www.paystation.co.nz/direct/paystation.dll

Required POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| paystation | Transaction initiator flag | Required for payment engine | String value | _empty |

| pstn_nr | No Redirect flag | Required for payment engine | Single character "t" or "T" | T |

| pstn_pi | Paystation ID | The Paystation ID | String value | 612345 |

| pstn_gi | Gateway ID | The Gateway ID | String value | PAYSTATION |

| pstn_ms | Merchant Session ID | A unique identifier for every transaction attempt | String value (max 64 chars) | qwertyuiop1234567890 |

| pstn_am | Amount | Transaction amount | Integer only, default format is cents | 4200 |

Optional POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_cu | Currency | Currency the transaction will be created in | String value | USD |

| pstn_tm | Test mode | Used to create a transaction in test mode | Single character "t" or "T" | T |

| pstn_mr | Merchant reference | A non-unique identifier that can be assigned to a transaction | String value (max 64 chars) | abc123 |

| pstn_ct | Card type | Stating the card type can bypass the card selection screen of a 3-party transaction | String value (max 64 chars) | visa |

| pstn_df | Card expiry date format | Defines the format of the expiry date | "mmyy" or "yymm" | mmyy |

| pstn_af | Amount format | Defines the format of the amount | String value "dollars.cents" or "cents" | dollars.cents |

| pstn_mc | Customer details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_mo | Order details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_du | Dynamic Return URL | The URL to re-direct the customer to after a 3-party transaction | URL encoded string value | https://paymentmaker.com/returnurl |

| pstn_dp | Dynamic POST Response URL | The URL to send the POST Response to after a 3-party transaction | URL encoded string value | https://paymentmaker.com/postresponseurl |

| pstn_rf | Return format | Defines the response format from Paystation (default is XML) | String value | JSON |

| pstn_rl | Retailer location | Location of the retailer for the goods or services (Case sensitive) | String value "DOMESTIC_ONLY", "FOREIGN_ONLY" or "FOREIGN_AND_DOMESTIC" | DOMESTIC_ONLY |

HTTP response

The above request returns on SUCCESS an XML response structured like this:

<?xml version="1.0" standalone="yes"?>

<InitiationRequestResponse>

<Username>123456</Username>

<RequestIP>192.168.1.1</RequestIP>

<RequestUserAgent>Mozilla/5.0 (Windows NT 10.0; WOW64)</RequestUserAgent>

<RequestHttpReferrer/>

<PaymentRequestTime>2017-01-13 09:41:13</PaymentRequestTime>

<DigitalOrder>https://payments.paystation.co.nz/hosted/?hk=kzh8KrOQBMsLfyhQUDbdbCoLP-wHTUZM</DigitalOrder>

<DigitalOrderTime>2017-01-13 09:41:13</DigitalOrderTime>

<DigitalReceiptTime/>

<PaystationTransactionID>0085789745-01</PaystationTransactionID>

</InitiationRequestResponse>

The above command returns on FAILURE an XML response structured like this:

The error message and code will vary depending on the error

<?xml version="1.0" standalone="yes"?>

<response>

<ec>8</ec>

<em>Transaction type not supported</em>

</response>

| Attribute | Name | Description | Type | Example |

|---|---|---|---|---|

| Username | Paystation account ID | The Paystation account ID that initiated the transaction | integer | 123456 |

| RequestIP | Request ip | The ip used in the initiation of the request | string | 192.168.1.1 |

| RequestUserAgent | Request user agent | String that identifies the application client that initiated the transaction request | string | Mozilla/5.0 |

| RequestHttpReferrer | Request http referrer | HTTP referrer header if applicable to original transaction request | string value | https://www.example.com |

| PaymentRequestTime | Payment request time | The time the transaction was initiated at | datetime | 2017-01-13 09:38:26 |

| DigitalOrder | Digital order URL | The hosted payment page URL link for the transaction | URL | https://payments.paystation.co.nz/hosted/?hk=12345 |

| DigitalOrderTime | Digital order time | The hosted payment page URL link for the transaction | datetime | 2018-03-11 02:40:16 |

| DigitalReceiptTime | Digital receipt time | Timestamp the transaction URL was created (does not apply to 2-party transactions) | datetime | 2018-03-11 02:40:16 |

| PaystationTransactionID | Paystation transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

PayMe

Example request

POST https://www.paystation.co.nz/direct/paystation.dll

POST body parameters

paystation=_empty

&pstn_nr=t

&pstn_pi=123456

&pstn_gi=PAYSTATION

&pstn_co=t

This endpoint is used to create a PayMe payment URL

HTTP request

POST https://www.paystation.co.nz/direct/paystation.dll

Required POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| paystation | Transaction initiator flag | Required for payment engine | String value | _empty |

| pstn_nr | No Redirect flag | Required for payment engine | Single character "t" or "T" | T |

| pstn_pi | Paystation ID | The Paystation ID | String value | 612345 |

| pstn_gi | Gateway ID | The Gateway ID | String value | PAYSTATION |

| pstn_co | PayMe order flag | Required for a PayMe transaction | Single character "t" or "T" | T |

Optional POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_am | Amount | Transaction amount | Integer only, default format is cents | 4200 |

| pstn_cu | Currency | Currency the transaction will be created in | String value | USD |

| pstn_tm | Test mode | Used to create a transaction in test mode | Single character "t" or "T" | T |

| pstn_mr | Merchant reference | A non-unique identifier that can be assigned to a transaction | String value (max 64 chars) | abc123 |

| pstn_ct | Card type | Stating the card type can bypass the card selection screen of a 3-party transaction | String value (max 64 chars) | visa |

| pstn_df | Card expiry date format | Defines the format of the expiry date | "mmyy" or "yymm" | mmyy |

| pstn_af | Amount format | Defines the format of the amount | String value "dollars.cents" or "cents" | dollars.cents |

| pstn_mc | Customer details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_mo | Order details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_rf | Return format | Defines the response format from Paystation (default is XML) | String value | JSON |

| pstn_tc | Terms and conditions flag | Will add to our hosted page a tick box and a link to the merchants T&Cs | Single character "t" or "T" | T |

| pstn_cj | PayMe custom fields | Information and custom fields to be displayed on the PayMe order details page | Url encoded string value of JSON format: {"reference": "PayMe reference","description": "A description for a PayMe example","single": "N"} where reference is your identifier (ie: an invoice number), description is the type of reference, and single (Y/N) denotes single payment |

%7B%22reference%22%3A%20%22PayMe%20reference%22%2C%22description%22%3A%20%22A%20description%20for%20a%20PayMe%20example%22%2C%22single%22%3A%20%22N%22%7D |

HTTP response

The above command returns on SUCCESS an XML response structured like this:

<?xml version="1.0" standalone="yes"?>

<PaystationPayMeOrderCreationResponse>

<PayMeOrderURL>https://payments.paystation.co.nz/pay/ry-3ksghqHg6GA06sgMPnyclUh_FaeANCER7P226hWM</PayMeOrderURL>

<PayMeOrderID>16550</PayMeOrderID>

<ec>0</ec>

<em>Transaction successful</em>

<PaystationErrorCode>0</PaystationErrorCode>

<PaystationErrorMessage>Transaction successful</PaystationErrorMessage>

<RequestIP>192.168.1.1</RequestIP>

</PaystationPayMeOrderCreationResponse>

The above command returns on FAILURE an XML response structured like this:

The error message and code will vary depending on the error

<?xml version="1.0" standalone="yes"?>

<response>

<ec>8</ec>

<em>Transaction type not supported</em>

</response>

| Attribute | Name | Description | Type | Example |

|---|---|---|---|---|

| PayMeOrderURL | PayMe order URL | The hosted payment page URL link for the transaction | URL | https://payments.paystation.co.nz/hosted/?hk=12345 |

| PayMeOrderID | PayMe order ID | A unique identifier assigned to each PayMe transaction | integer | 12345 |

| ec | Error code | The error code status of the transaction | integer | 1 |

| em | Error message | The error message status of the transaction | string | Transaction successful |

| PaystationErrorCode | Error code | The error code status of the transaction | integer | 1 |

| PaystationErrorMessage | Error message | The error message status of the transaction | string | Transaction successful |

| RequestIP | Request ip | The ip used in the initiation of the request | string | 192.168.1.1 |

TXN Confirmation

There are a number of ways you can confirm the transaction response.

Use a GET to redirect from the hosted page (return URL).

A POST response will send the transaction details in an XML packet after we have received the transaction response from the acquiring bank.

A Quick lookup will send a query to Paystation. We will send an XML formatted response once the transaction has been completed. Quick lookup requires IP limiting or HMAC authentication.

Use Dynamic return to control the GET (redirect from the hosted page) and POST response. Dynamic return requires HMAC authentication.

HMAC authentication can be used in lieu of IP limiting for transactions that require it

POST response

After the transaction is processed, the response will be returned to your POST response URL. POST response URLs are either fixed and stored against your Paystation account, or can be dynamic, using our Dynamic return URL.

If you are using a token integration, the response (on token initiator and save only transactions) is sent as a browser redirect in the form of a standard HTTP GET query. You will be able to extract the response values using the standard tools available within your development environment.

POST response addendum

Example POST response XML packet:

<?xml version="1.0" standalone="yes"?>

<PaystationPaymentVerification>

<Username>123456</Username>

<MerchantSession>1168475644.8</MerchantSession>

<UsedAcquirerMerchantID>123456</UsedAcquirerMerchantID>

<TransactionID>0000743943-01</TransactionID>

<PurchaseAmount>7500</PurchaseAmount>

<Locale>en</Locale>

<ReturnReceiptNumber>000000000165</ReturnReceiptNumber>

<ShoppingTransactionNumber>195</ShoppingTransactionNumber>

<AcqResponseCode>00</AcqResponseCode>

<QSIResponseCode>0</QSIResponseCode>

<CSCResultCode>U</CSCResultCode>

<AVSResultCode>U</AVSResultCode>

<TransactionTime>2017-01-11 13:40:33</TransactionTime>

<PaystationErrorCode>0</PaystationErrorCode>

<Authentication>

<auth_Type/>

<auth_Status/>

<auth_SecurityLevel/>

<auth_HashToken/>

<auth_3DSID/>

<auth_3DSElectronicCommerceIndicator/>

<auth_3DSEnrolled/>

<auth_3DSStatus/>

</Authentication>

<BatchNumber>20070111</BatchNumber>

<AuthorizeID>R81194</AuthorizeID>

<Cardtype>MC</Cardtype>

<CustomerIP>222.152.4.143</CustomerIP>

<CustomerUserAgent>Mozilla/4.0 (compatible; MSIE 6.0; Windows NT 5.1)</CustomerUserAgent>

<PaymentRequestTime>2017-01-11 13:39:09</PaymentRequestTime>

<PaymentResponseTime>2017-01-11 13:40:33</PaymentResponseTime>

<UserAdditionalVars>

<txn_mode>Liv</txn_mode>

</UserAdditionalVars>

</PaystationPaymentVerification>

POST response is an XML packet that is generated immediately before the customer redirect is issued, and is directed to a pre-defined POST response URL.

In the event of POST response failure, a system generated email will be sent to the authorised email address. This email will list transaction details such as the transaction identifier ti, the merchant session pstn_ms, the merchant reference pstn_mr, date, time, and the POST response error.

HTTP response

After a transaction is processed the POST response will be returned to your Paystation POST response URL (either static or dynamic).

The response is sent from our processing servers as a standard POST request directly to the specified URL. The specified URL must be accessible from the Internet. The response is in the form of XML in the POST body. You will be able to extract the response values using the standard tools available within your development environment.

| Parameter | Name | Description | Example |

|---|---|---|---|

| Username | Paystation User Name | BIN. The first 6 digits of a credit card number | 519163 |

| UsedAcquirerMerchantID | Used acquirer merchant id | The acquirer’s merchant ID used for the transaction | integer |

| TransactionID | Transaction ID | A string containing the unique transaction ID assigned to the transaction attempt by the Paystation server | string |

| PurchaseAmount | Purchase amount | The amount of the transaction, in cents | 4200 |

| Locale | Locale | The locale of the transaction. The payment server does support different languages, although this is not currently implemented. Would normally be set to “en” | en |

| ReturnReceiptNumber | Return Receipe Number | The RRN number is a virtual terminal counter for the transaction and is not unique | Integer |

| ShoppingTransactionNumber | Shopping Transaction Number | Unique bank reference assigned to the transaction | Integer |

| AcqResponseCode | Acquirer's Response Code | The result code’s vary from acquirer to acquirer and is included for debugging purposes. Please process transaction result from the PaystationErrorCode | Integer |

| QSIResponseCode | QSI Response Code | Payment Server Response code – the actual raw result from the payment server. Please process transaction result from the PaystationErrorCode | Integer |

| AVSResultCode | AVS Result Code | Result of any AVS validation. Not supported in New Zealand | Empty |

| TransactionTime | Transaction Time | The time the transaction was initiated at Paystation | datetime |

| PaystationErrorCode | Paystation Error Code | The result of the transaction | integer |

3DS Authentication Tags

If your transaction needs to be validated by 3DS .....

| Parameter | Name | Description | Example |

|---|---|---|---|

| auth_Type | Authentication Type | This will always be '3DS' | 3DS |

The Authentication status can return numerous responses Y | E | N | U | F | A | D | C | S | P | I

Dynamic return url

Paystation have a Dynamic return API for integration types that require it.

Paystation have a Dynamic return API for integration types that require it.

In a standard Paystation integration, we require the return and POST response URLs to be supplied to Paystation, these are fixed against an account on the gateway. You can provide us with a single URL for return and POST response, or we can have separate URLs for successful/unsuccessful transactions and test/production transactions, along with test/production POST response URLs

Using dynamic return URLs the GET (return URL) and POST (POST response URL) can be specified during the transaction initiation phase of a hosted transaction. These can be varied per transaction, and be controlled completely by the merchants website, rather than being fixed by Paystation.

HTTP response

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_du | Dynamic Return URL | The URL to re-direct the customer to after a 3-party transaction | URL encoded string value | https://paymentmaker.com/returnurl |

| pstn_dp | Dynamic POST Response URL | The URL to send the POST Response to after a 3-party transaction | URL encoded string value | https://paymentmaker.com/postresponseurl |

Quick lookup

Request

Example request

GET https://payments.paystation.co.nz/lookup?pi={PAYSTATION_ID}&ti={TXN_ID}

GET query parameters

pi=123456

&ti=0123456789-01

The above command returns on SUCCESS an XML response structured like this:

<PaystationQuickLookup>

<LookupStatus>

<LookupCode>00</LookupCode>

<LookupMessage>Successful</LookupMessage>

<RemoteHostAddress>192.168.1.1</RemoteHostAddress>

</LookupStatus>

<LookupResponse>

<CardNo/>

<CardExpiry/>

<CardholderName/>

<AcquirerName>ASB</AcquirerName>

<AcquirerMerchantID/>

<PaystationUserID/>

<PaystationTransactionID>0085710398-01</PaystationTransactionID>

<MerchantSession>4653ca3f-7967-4ac5-8661-1e034e2478a4</MerchantSession>

<TransactionTime>2017-01-11 14:48:19</TransactionTime>

<PurchaseAmount>5000</PurchaseAmount>

<ReturnReceiptNumber/>

<ShoppingTransactionNumber/>

<AcquirerResponseCode/>

<QSIResponseCode/>

<PaystationErrorCode/>

<BatchNumber/>

<CardType/>

<AuthorizeID/>

<POPPErrorCode/>

<POPPErrorMessage/>

<TransactionProcess>purchase</TransactionProcess>

<RefundAmount/>

<PaystationErrorMessageExtended/>

<FuturePaymentToken/>

<SurchargeAmount/>

<TotalSuccessfulRefunds>0</TotalSuccessfulRefunds>

<TotalSuccessfulCaptures>0</TotalSuccessfulCaptures>

<PaystationErrorMessage>Incomplete</PaystationErrorMessage>

<Authentication>

<auth_Type/>

<auth_Status/>

<auth_SecurityLevel/>

<auth_HashToken/>

<auth_3DSID/>

<auth_3DSElectronicCommerceIndicator/>

<auth_3DSEnrolled/>

<auth_3DSStatus/>

</Authentication>

<HostedTransactionFlow>

<RemoteServerInitiationRequest>2017-01-11 14:48:19</RemoteServerInitiationRequest>

<PaystationInitiationResponse>2017-01-11 14:48:19</PaystationInitiationResponse>

<BrowserRequestedCardSelectionScreen/>

<PaystationReturnedCardSelectionScreen/>

<BrowserRequestedCardDetailsScreen/>

<PaysationReturnedCardDetailsScreen/>

<BrowserSubmittedCardDetails/>

<ThreeDSMPIRequestInitiated/>

<ThreeDSMPIResponseReceived/>

<PaystationPaymentThreadStarted/>

<PaystationPaymentInitiationConfirmation/>

<PaystationLinkedGatewayMessageSent/>

<AcquirerLinkResponseReceived/>

<ThreeDSAuthenticationRequestSent/>

<ThreeDSAuthenticationResponseReceived/>

<PaystationPOSTResponseCompleted/>

<BrowserPaymentStatusCheck/>

<PaystationPaymentStatusResponse/>

<PaystationTransactionCompletedResponse/>

</HostedTransactionFlow>

</LookupResponse>

</PaystationQuickLookup>

The above command returns on FAILURE an XML response structured like this (The error code/message will vary depending on the resulting failure):

The error message and code will vary depending on the error

<?xml version="1.0" standalone="yes"?>

<PaystationQuickLookup>

<LookupStatus>

<LookupCode>03</LookupCode>

<LookupMessage>Access denied for user [123456]</LookupMessage>

<RemoteHostAddress>123.123.123.12</RemoteHostAddress>

</LookupStatus>

</PaystationQuickLookup>

Quick lookup queries are initiated via an HTTP GET query to a Paystation Lookup URL. The response is sent directly back as an XML formatted response. This response includes the relevant parameters sent through to Paystation from the cart transaction, financial transaction and authentication data from the bank's Internet gateway stored at the time of the purchase transaction. The lookup can be referenced by either a previously used merchant session (ms) value, and/or from the transaction identitfier (ti).

HTTP request

GET https://payments.paystation.co.nz/lookup/

Required POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pi | Paystation ID | The Paystation ID | String value | 612345 |

Required choice query parameters

With Quick lookup you have two options available in terms of identifying a transaction - the merchant session (ms), or the transaction id (ti). The API will accept either of these two parameters to identify a transaction, or alternatively you can use both.

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| ms | Merchant Session ID | The unique identification code sent to Paystation as the pstn_ms value in the original payment request |

String value (max 64 chars) | qwertyuiop1234567890 |

| ti | Transaction ID | The original transaction ID that Paystation has assigned to the transaction | String value | 0084873084-01 |

HTTP response

The response is sent in the form of an XML packet. You will be able to extract the response values using the standard tools available within your development environment

| Parameter | Name | Description | Example |

|---|---|---|---|

| AcquirerName | Merchants Acquirer Name | The merchants acquirer name | string |

| AcquirerMerchantID | Acquirer Merchant ID | The acquirer’s merchant ID used for the transaction | integer |

| PaystationUserID | Paystation username | Paystation user name used to create transaction | string |

| PaystationTransactionID | Transaction ID | A string containing the unique transaction ID assigned to the transaction attempt by the Paystation server | string |

| PurchaseAmount | Purchase Amount | The amount of the transaction, in cents | 4200 |

| MerchantSession | Merchant Session | A string containing the unique reference assigned to the transaction by the merchants system | string |

| ReturnReceiptNumber | Return Receipt Number | The RRN number is a virtual terminal counter for the transaction and is not unique | Integer |

| ShoppingTransactionNumber | Shopping Transaction Number | Unique bank reference assigned to the transaction | Integer |

| AcquirerResponseCode | Acquirer’s response code | The result code’s vary from acquirer to acquirer and is included for debugging purposes. Please process transaction result from the PaystationErrorCode | Integer |

| QSIResponseCode | QSI Response Code | Payment Server Response code – the actual raw result from the payment server. Please process transaction result from the PaystationErrorCode | Integer |

| PaystationErrorCode | Paystation Error Code | The result of the transaction | integer |

| BatchNumber | Batch Number | The Batch number on the Payment Server that this transaction will be added to in order to be processed by the acquiring institution | date MMDD |

| Cardtype | Card type | The card type used | MASTERCARD |

Errors

A Quick Lookup response XML packet is broken down into two separate xml element groups, the LookupStatus and the LookupResponse

LookupStatus errors

The LookupStatus holds the data depending on wherever the actual request for the Lookup was successful

Through the LookupCode and LookupMessage xml elements of a LookupStatus you will obtain an error code that corresponds to the below link

The LookupStatus error's are all standard lookup errors found here

LookupResponse errors

The LookupResponse holds the data depending on the outcome of the transaction found.

The LookupResponse error's are all standard transaction errors found here

Refund

Using our Refund API you can process a refund remotely using an API call.

Refund transaction

Refund a transaction directly using the corresponding transaction ID

2 party

Example Request

POST https://www.paystation.co.nz/direct/paystation.dll

POST body parameters

paystation=_empty

&pstn_nr=t

&pstn_pi=123456

&pstn_gi=PAYSTATION

&pstn_ms=abcd-defg-hijk

&pstn_am=5000

&pstn_2p=t

&pstn_rc=t

&pstn_rt=00123456789-01

This endpoint is used for refunding a transaction. This is a 2 party transaction.

HTTP request

POST https://www.paystation.co.nz/direct/paystation.dll

Required POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| paystation | Transaction initiator flag | Required for payment engine | String value | _empty |

| pstn_nr | No Redirect flag | Required for payment engine | Single character "t" or "T" | T |

| pstn_pi | Paystation ID | The Paystation ID | String value | 612345 |

| pstn_gi | Gateway ID | The Gateway ID | String value | PAYSTATION |

| pstn_ms | Merchant Session ID | A unique identifier for every transaction attempt | String value (max 64 chars) | qwertyuiop1234567890 |

| pstn_am | Amount | Transaction amount | Integer only, default format is cents | 4200 |

| pstn_2p | Two party flag | Required for 2-party transactions | Single character "t" or "T" | T |

| pstn_rc | Refund flag | Required for refund transactions | Single character "t" or "T" | T |

| pstn_rt | Refund transaction ID | The transaction ID to be refunded | String value | 0066758901-01 |

Optional POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_tm | Test mode | Used to create a transaction in test mode | Single character "t" or "T" | T |

| pstn_mr | Merchant reference | A non-unique identifier that can be assigned to a transaction | String value (max 64 chars) | abc123 |

| pstn_mc | Customer details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_mo | Order details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_rf | Return format | Defines the response format from Paystation (default is XML) | String value | JSON |

Optional query string parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_HMACTimestamp | HMAC Timestamp | The timestamp generated immediately before the request is generated | integer | 1481496738 |

| pstn_HMAC | HMAC Hash | A hash of the request, the HMAC timestamp and the HMAC key | string | abc12345 |

Return response

The above request returns on SUCCESS an XML response structured like this:

<?xml version="1.0" standalone="yes"?>

<PaystationRefundResponse>

<ec>0</ec>

<em>Transaction successful</em>

<ti>0085793423-01</ti>

<ct>mastercard</ct>

<merchant_ref/>

<tm>T</tm>

<MerchantSession>abcd-defg-hijk</MerchantSession>

<UsedAcquirerMerchantID/>

<TransactionID>0085793423-01</TransactionID>

<RefundAmount>5000</RefundAmount>

<SurchargeAmount/>

<Locale>en</Locale>

<ReturnReceiptNumber>85793423</ReturnReceiptNumber>

<ShoppingTransactionNumber/>

<AcqResponseCode>00</AcqResponseCode>

<QSIResponseCode>0</QSIResponseCode>

<CSCResultCode/>

<AVSResultCode/>

<TransactionTime>2017-01-13 11:09:03</TransactionTime>

<PaystationErrorCode>0</PaystationErrorCode>

<PaystationErrorMessage>Transaction successful</PaystationErrorMessage>

<PaystationExtendedErrorMessage/>

<MerchantReference/>

<CardNo>555555XXXXXXX444</CardNo>

<CardExpiry>1705</CardExpiry>

<TransactionProcess>refund</TransactionProcess>

<TransactionMode>T</TransactionMode>

<BatchNumber>0113</BatchNumber>

<AuthorizeID/>

<Cardtype>MC</Cardtype>

<Username>123456</Username>

<RequestIP>192.168.1.1</RequestIP>

<RequestUserAgent>Mozilla/5.0 (Windows NT 10.0; WOW64)</RequestUserAgent>

<RequestHttpReferrer/>

<PaymentRequestTime>2017-01-13 11:09:03</PaymentRequestTime>

<DigitalOrderTime>2017-01-13 11:09:03</DigitalOrderTime>

<DigitalReceiptTime/>

<PaystationTransactionID/>

<RefundedAmount>5000</RefundedAmount>

<CapturedAmount/>

</PaystationRefundResponse>

The above request returns on FAILURE an XML response structured like this (The error code/message will vary depending on the resulting failure):

The error message and code will vary depending on the error

<?xml version="1.0" standalone="yes"?>

<PaystationRefundResponse>

<ec>14</ec>

<em>Transaction could not be found</em>

<ti>0085793478-01</ti>

<ct/>

<merchant_ref/>

<tm>P</tm>

<MerchantSession>abcd-defg-hijk</MerchantSession>

<UsedAcquirerMerchantID/>

<TransactionID>0085793478-01</TransactionID>

<RefundAmount>5000</RefundAmount>

<SurchargeAmount/>

<Locale>en</Locale>

<ReturnReceiptNumber/>

<ShoppingTransactionNumber/>

<AcqResponseCode/>

<QSIResponseCode/>

<CSCResultCode/>

<AVSResultCode/>

<TransactionTime>2017-01-13 11:10:06</TransactionTime>

<PaystationErrorCode>14</PaystationErrorCode>

<PaystationErrorMessage>Transaction could not be found</PaystationErrorMessage>

<PaystationExtendedErrorMessage/>

<MerchantReference/>

<TransactionProcess>refund</TransactionProcess>

<TransactionMode>P</TransactionMode>

<BatchNumber/>

<AuthorizeID/>

<Cardtype/>

<Username>123456</Username>

<RequestIP>192.168.1.1</RequestIP>

<RequestUserAgent>Mozilla/5.0 (Windows NT 10.0; WOW64)</RequestUserAgent>

<RequestHttpReferrer/>

<PaymentRequestTime>2017-01-13 11:10:06</PaymentRequestTime>

<DigitalOrderTime/>

<DigitalReceiptTime/>

<PaystationTransactionID/>

</PaystationRefundResponse>

| Attribute | Name | Description | Type | Example |

|---|---|---|---|---|

| ec | Error code | The error code status of the transaction | integer | 1 |

| em | Error message | The error message status of the transaction | string | Transaction successful |

| ti | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| ct | Card type | The card issuer | string | mastercard |

| merchant_ref | A non-unique identifier that can be assigned to a transaction | string | abc123 | |

| tm | Test mode | Denotes if the transaction was completed in test mode or not | string | t |

| MerchantSession | Merchant Session ID | A unique value to identify a transaction by | string | abcd-defg-hijk |

| UsedAcquirerMerchantID | ||||

| TransactionID | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| PurchaseAmount | Purchase amount | A positive integer in cent value or alternatively the option specified in the transaction representing the charged amount | positive integer or zero | 5000 |

| SurchargeAmount | Surcharge amount added to transaction amount | Integer only | default format is cents | 4200 |

| Locale | Locale | The language tag represents the language the response text is provided in | string value | en |

| ReturnReceiptNumber | Return receipt number | The RRN number is a virtual terminal counter for the transaction and is not unique | positive 8 digit number | 85789579 |

| ShoppingTransactionNumber | Shopping transaction number | Is a unique number relating to the Transaction ID (eGate integration's only) | Integer | 85793423 |

| AcqResponseCode | Acq response code | Transaction response code from the acquiring bank | Integer | 00 |

| QSIResponseCode | QSI response code | Issuing bank response code – the actual raw result from the payment server. Please process transaction result from the PaystationErrorCode | Integer | 0 |

| CSCResultCode | CSC result code | The response code in response to verifying the card security code if applicable to transaction | Single character | "M" |

| AVSResultCode | AVS result code | Result of any AVS validation. Not supported in New Zealand | Empty | |

| TransactionTime | Transaction time | The time the transaction was completed | datetime | 2017-01-13 09:38:26 |

| PaystationErrorCode | Error code | The error code status of the transaction | integer | 1 |

| PaystationErrorMessage | Error message | The error message status of the transaction | string | Transaction successful |

| PaystationExtendedErrorMessage | Extended error message | Extra information regarding the error code if applicable | string value | Refer to card issuer |

| MerchantReference | Merchant reference | A non-unique identifier that can be assigned to a transaction | string | abc123 |

| CardNo | Card number | A masked card number of the card that completed the transaction | string | 555555XXXXXXX444 |

| CardExpiry | Card expiry date | The expiry of the card that completed the transaction | date YYMM | 1705 |

| TransactionProcess | Transaction process | The transaction method identification | string | refund |

| TransactionMode | Transaction mode | T or P represents the transaction is a test (T) or production (P) transaction | string value | T |

| BatchNumber | Batch number | A four digit number representing the expected settlement date of the transaction in the format MMDD | positive integer | 0013 |

| AuthorizeID | Authorize ID | A unique reference provided by the bank to trace the transaction | integer | R81194 |

| Cardtype | Card type | The card issuer | string | MC |

| Username | Paystation account ID | The Paystation account ID that initiated the transaction | integer | 123456 |

| RequestIP | Request ip | The ip used in the initiation of the request | string | 192.168.1.1 |

| RequestUserAgent | Request user agent | String that identifies the application client that initiated the transaction request | string | Mozilla/5.0 |

| RequestHttpReferrer | Request http referrer | HTTP referrer header if applicable to original transaction request | string value | https://www.example.com |

| PaymentRequestTime | Payment request time | The time the transaction was initiated at | datetime | 2017-01-13 09:38:26 |

| DigitalOrderTime | Digital order time | Timestamp the transaction URL was created (does not apply to 2-party transactions) | datetime | 2018-03-11 02:40:16 |

| DigitalReceiptTime | Digital receipt time | Timestamp the transaction response was received by the card switch | datetime | 2018-03-11 02:40:16 |

| PaystationTransactionID | Paystation transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| RefundAmount | Refunded amount | The amount refunded in the transaction | positive integer | 5000 |

| CapturedAmount | Captured amount | The amount captured in the transaction (does not apply to a refund request) | positive integer | 1000 |

Auth and Capture

Using authorisations and captures means that you use an authorisation to verify that the card details are correct, and it sets money aside on the card balance. The benefit here is that you can guarantee an amount and then finalize payment once the details have been confirmed.

What it is: The customer gives you authority to take up to a set amount from their credit card.

How it works: You capture some or the entire authorised amount. When the customer is giving authority, your website tells Paystation the amount to authorise. The customer enters their credit card details into the payment page and the details go directly to the bank. When you are ready you are able to capture up to that amount in single or multiple captures.

Benefit: A credit or debit card can be validated for the purposes of future transactions against that card.

Downside: An authorisation is active for a set period of time and is controlled by the acquiring bank (the bank providing the merchant facility). If the authorisation is left for too long prior to capture, the credit card may have expired, or the balance will have changed, between the time when the authorisation is given and the amount is captured.

Who uses authorisation / capture (sometimes referred to as a pre-auth): Accommodation services, and food delivery services are the most common, but any business that needs to confirm an order availability, or with goods and services subject to change can benefit from using pre authorised payments.

Authorisation

An authorisation confirms that the card number and expiry date are correct. It also sets aside a specific amount of money on that card, which means that the cardholder cannot access those funds until the authorisation has been released, or the funds captured.

2 party

Example request

POST https://www.paystation.co.nz/direct/paystation.dll

POST body parameters

paystation=_empty

&pstn_nr=t

&pstn_pi=123456

&pstn_gi=PAYSTATION

&pstn_ms=abcd-defg-hijk

&pstn_am=5000

&pstn_2p=t

&pstn_cn=5555555555554444

&pstn_ex=1705

&pstn_pa=t

This endpoint is used to initiate a 2 party transaction

HTTP request

POST https://www.paystation.co.nz/direct/paystation.dll

Required POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| paystation | Transaction initiator flag | Required for payment engine | String value | _empty |

| pstn_nr | No Redirect flag | Required for payment engine | Single character "t" or "T" | T |

| pstn_pi | Paystation ID | The Paystation ID | String value | 612345 |

| pstn_gi | Gateway ID | The Gateway ID | String value | PAYSTATION |

| pstn_ms | Merchant Session ID | A unique identifier for every transaction attempt | String value (max 64 chars) | qwertyuiop1234567890 |

| pstn_am | Amount | Transaction amount | Integer only, default format is cents | 4200 |

| pstn_2p | Two party flag | Required for 2-party transactions | Single character "t" or "T" | T |

| pstn_cn | Card number | Credit/debit card number (13 - 19 characters) | Integer, no spaces in between card numbers | 5555555555554444 |

| pstn_ex | Card expiry date | Four character expiry date | Integer, no spaces in between year and month (default is yymm format) | 1705 |

| pstn_pa | Authorisation flag | Required for authorisation transactions | Single character "t" or "T" | T |

Optional POST body parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_cu | Currency | Currency the transaction will be created in | String value | USD |

| pstn_tm | Test mode | Used to create a transaction in test mode | Single character "t" or "T" | T |

| pstn_mr | Merchant reference | A non-unique identifier that can be assigned to a transaction | String value (max 64 chars) | abc123 |

| pstn_ct | Card type | Stating the card type can bypass the card selection screen of a 3-party transaction | String value (max 64 chars) | visa |

| pstn_df | Card expiry date format | Defines the format of the expiry date | "mmyy" or "yymm" | mmyy |

| pstn_af | Amount format | Defines the format of the amount | String value "dollars.cents" or "cents" | dollars.cents |

| pstn_mc | Customer details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_mo | Order details | A non-unique identifier that can be assigned to a transaction | String value (max 255 chars) | abc123 |

| pstn_cc | Card security code | Three/Four digit code found on back of credit/debit card | String value | 100 |

| pstn_rf | Return format | Defines the response format from Paystation (default is XML) | String value | JSON |

Optional query string parameters

| Parameter | Name | Description | Value | Example |

|---|---|---|---|---|

| pstn_HMACTimestamp | HMAC Timestamp | The timestamp generated immediately before the request is generated | integer | 1481496738 |

| pstn_HMAC | HMAC Hash | A hash of the request, the HMAC timestamp and the HMAC key | string | abc12345 |

Return response

The above command returns on SUCCESS an XML response structured like this:

<?xml version="1.0" standalone="yes"?>

<response>

<ec>0</ec>

<em>Transaction successful</em>

<ti>0085898476-01</ti>

<ct>mastercard</ct>

<merchant_ref/>

<tm>T</tm>

<MerchantSession>abcd-defg-hijk</MerchantSession>

<UsedAcquirerMerchantID/>

<TransactionID>0085898476-01</TransactionID>

<PurchaseAmount>5000</PurchaseAmount>

<SurchargeAmount/>

<Locale/>

<ReturnReceiptNumber>85898476</ReturnReceiptNumber>

<ShoppingTransactionNumber/>

<AcqResponseCode>00</AcqResponseCode>

<QSIResponseCode>0</QSIResponseCode>

<CSCResultCode/>

<AVSResultCode/>

<TransactionTime>2017-01-16 09:09:22</TransactionTime>

<PaystationErrorCode>0</PaystationErrorCode>

<PaystationErrorMessage>Transaction successful</PaystationErrorMessage>

<PaystationExtendedErrorMessage/>

<MerchantReference/>

<CardNo>555555XXXXXXX444</CardNo>

<CardExpiry>1705</CardExpiry>

<TransactionProcess>authorisation</TransactionProcess>

<TransactionMode>T</TransactionMode>

<BatchNumber>0116</BatchNumber>

<AuthorizeID/>

<Cardtype>MC</Cardtype>

<Username>123456</Username>

<RequestIP>192.168.1.1</RequestIP>

<RequestUserAgent>Mozilla/5.0 (Windows NT 10.0; WOW64)</RequestUserAgent>

<RequestHttpReferrer/>

<PaymentRequestTime>2017-01-16 09:09:22</PaymentRequestTime>

<DigitalOrderTime/>

<DigitalReceiptTime>2017-01-16 09:09:22</DigitalReceiptTime>

<PaystationTransactionID>0085898476-01</PaystationTransactionID>

<IssuerName>unknown</IssuerName>

<IssuerCountry>unknown</IssuerCountry>

</response>

The above command returns on FAILURE an XML response structured like this (The error code/message will vary depending on the resulting failure):

The error message and code will vary depending on the error

<?xml version="1.0" standalone="yes"?>

<PaystationAuthorisationResponse>

<ec>41</ec>

<em>Card number has failed Luhn check</em>

<ti>0085898619-01</ti>

<ct/>

<merchant_ref/>

<tm>T</tm>

<MerchantSession>abcd-defg-hijk</MerchantSession>

<UsedAcquirerMerchantID/>

<TransactionID>0085898619-01</TransactionID>

<AuthoriseAmount>5000</AuthoriseAmount>

<SurchargeAmount/>

<Locale>en</Locale>

<ReturnReceiptNumber/>

<ShoppingTransactionNumber/>

<AcqResponseCode/>

<QSIResponseCode/>

<CSCResultCode/>

<AVSResultCode/>

<TransactionTime>2017-01-16 09:12:05</TransactionTime>

<PaystationErrorCode>41</PaystationErrorCode>

<PaystationErrorMessage>Card number has failed Luhn check</PaystationErrorMessage>

<PaystationExtendedErrorMessage/>

<MerchantReference/>

<TransactionProcess>purchase</TransactionProcess>

<TransactionMode>T</TransactionMode>

<BatchNumber/>

<AuthorizeID/>

<Cardtype/>

<Username>123456</Username>

<RequestIP>192.168.1.1</RequestIP>

<RequestUserAgent>Mozilla/5.0 (Windows NT 10.0; WOW64)</RequestUserAgent>

<RequestHttpReferrer/>

<PaymentRequestTime>2017-01-16 09:12:05</PaymentRequestTime>

<DigitalOrderTime/>

<DigitalReceiptTime/>

<PaystationTransactionID/>

<IssuerName>unknown</IssuerName>

<IssuerCountry>unknown</IssuerCountry>

</PaystationAuthorisationResponse>

| Attribute | Name | Description | Type | Example |

|---|---|---|---|---|

| ec | Error code | The error code status of the transaction | integer | 1 |

| em | Error message | The error message status of the transaction | string | Transaction successful |

| ti | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| ct | Card type | The card issuer | string | mastercard |

| merchant_ref | A non-unique identifier that can be assigned to a transaction | string | abc123 | |

| tm | Test mode | Denotes if the transaction was completed in test mode or not | string | t |

| MerchantSession | Merchant Session ID | A unique value to identify a transaction by | string | abcd-defg-hijk |

| UsedAcquirerMerchantID | ||||

| TransactionID | Transaction ID | A unique value applied to all transactions | string | 0123456789-01 |

| PurchaseAmount | Purchase amount | A positive integer in cent value or alternatively the option specified in the transaction representing the charged amount | positive integer or zero | 5000 |

| SurchargeAmount | ||||

| Locale | Locale | The language tag represents the language the response text is provided in | string value | en |

| ReturnReceiptNumber | Return receipt number | The RRN number is a virtual terminal counter for the transaction and is not unique | Integer | 85789579 |

| ShoppingTransactionNumber | Shopping transaction number | Is a unique number relating to the Transaction ID (eGate integration's only) | Integer | 85793423 |

| AcqResponseCode | Acq response code | Transaction response code from the acquiring bank | Integer | 00 |

| QSIResponseCode | QSI response code | Issuing bank response code – the actual raw result from the payment server. Please process transaction result from the PaystationErrorCode | Integer | 0 |

| CSCResultCode | CSC result code | The response code in response to verifying the card security code if applicable to transaction | Single character | "M" |

| AVSResultCode | AVS result code | Result of any AVS validation. Not supported in New Zealand | Empty | |

| TransactionTime | Transaction time | The time the transaction was completed | datetime | 2017-01-13 09:38:26 |

| PaystationErrorCode | Error code | The error code status of the transaction | integer | 1 |

| PaystationErrorMessage | Error message | The error message status of the transaction | string | Transaction successful |

| PaystationExtendedErrorMessage | Extended error message | Extra information regarding the error code if applicable | string value | Refer to card issuer |

| MerchantReference | Merchant reference | A non-unique identifier that can be assigned to a transaction | string | abc123 |

| CardNo | Card number | A masked card number of the card that completed the transaction | string | 555555XXXXXXX444 |

| CardExpiry | Card expiry date | The expiry of the card that completed the transaction | date YYMM | 1705 |

| TransactionProcess | Transaction process | The transaction method identification | string | purchase |